Are you a small business owner in Kenya looking for business loans to expand your business but struggling to provide collateral? If so, you’re in luck because there are business loan providers in Kenya that offer unsecured loans.

These loans are specifically designed for entrepreneurs who need funding but cannot provide any form of collateral.

In this article, we will explore the top business loan providers in Kenya that offer unsecured loans, giving you the opportunity to secure the financial support you need to take your business to the next level.

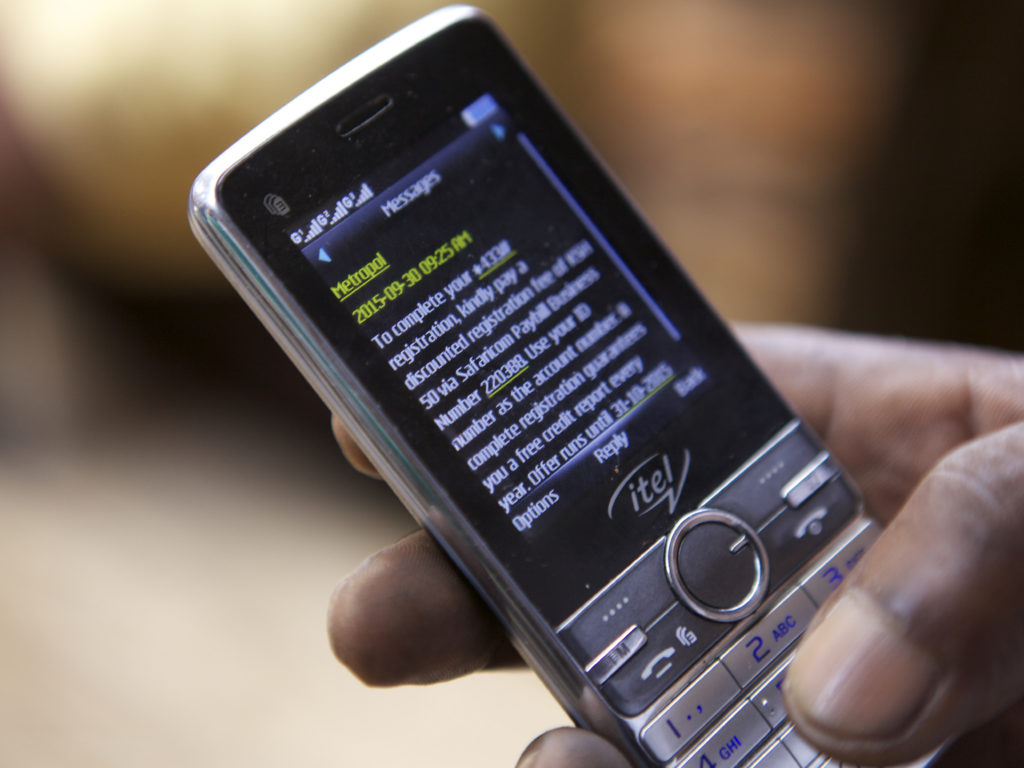

- M-Shwari – It is a mobile lending platform that provides unsecured loans to businesses in Kenya. The loans range from KES 100 to KES 70,000 with a repayment period of 30 days.

- Equity Bank – The bank offers unsecured loans to businesses without requiring any collateral. The loans range from KES 50,000 to KES 500,000 with a repayment period of up to 36 months.

- KCB Bank – KCB Bank provides unsecured business loans to small and medium-sized enterprises (SMEs) in Kenya. The loans range from KES 50,000 to KES 10 million with a repayment period of up to 36 months.

- Co-operative Bank – Co-operative Bank offers unsecured loans to businesses in Kenya without any collateral. The loans range from KES 50,000 to KES 20 million with a repayment period of up to 60 months.

- NIC Bank – NIC Bank provides unsecured loans to businesses without requiring any collateral. The loans range from KES 100,000 to KES 20 million with a repayment period of up to 48 months.

It is important to note that the interest rates on unsecured loans may be higher than those of secured loans since the financial institution takes on a higher risk by lending without collateral. Additionally, the lending criteria for unsecured loans may be stricter, and the borrower must have a good credit history and strong financial standing.

Drop Your Comments, What do you think About The Article?