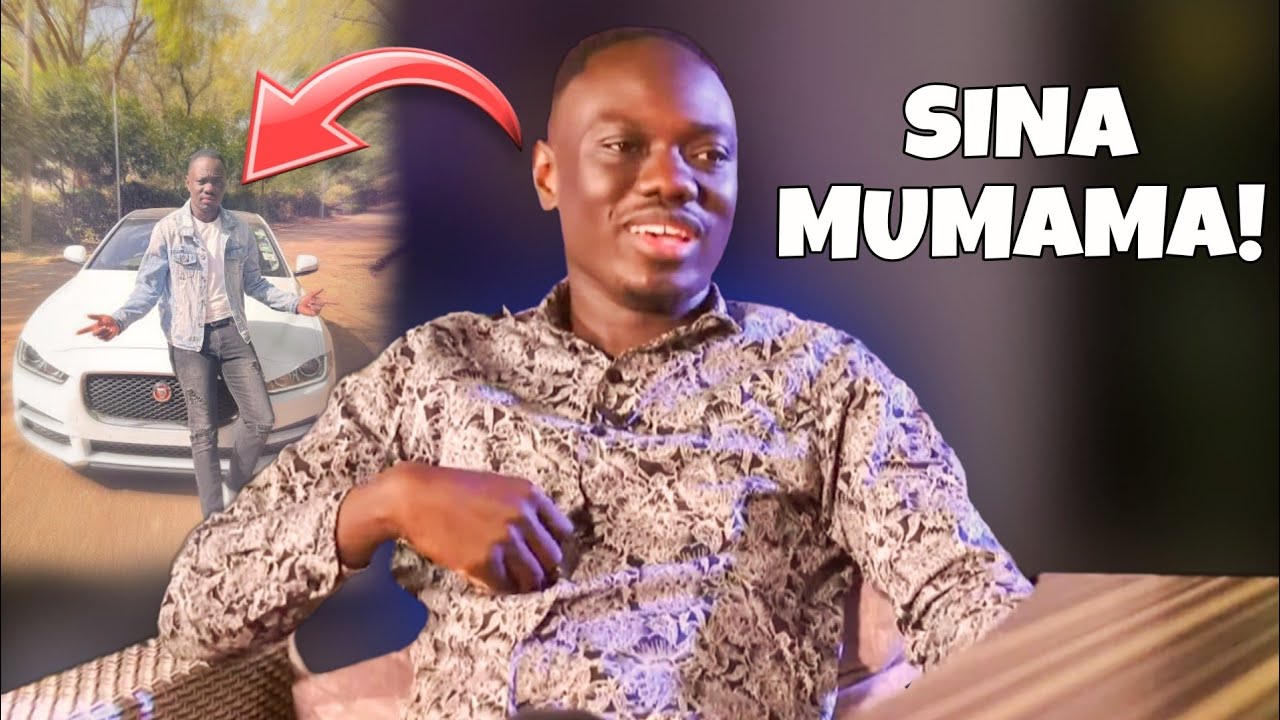

Meet David Samoei, William Ruto’s Little Known Brother and What He Does For a Living

David Samoei, who is Ruto’s blood brother tells his story. A story of hope and a story of champion. David’s road to prominence as a philanthropist, businessman, and master’s graduate from Capella University, USA began with a challenge some childhood that did not spare even his other 5 siblings DP Ruto included. He was born … Read more