Citizen TV News Anchor Yvonne Okwara Separates from Millionaire Husband Andrew Matole

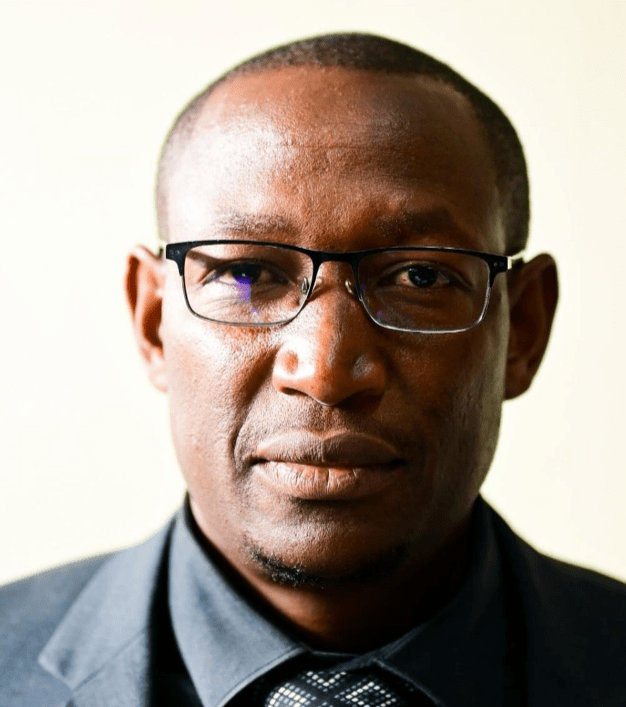

Celebrated Citizen TV news anchor Yvonne Okwara has separated from her husband Andrew Matole after just 10 years of marriage, sauce.co.ke can reliably report. Reliable sources have told us that the two love birds separated one month ago. They are no longer living together at their home in the upscale Loresho neighborhood of Nairobi. Yvonne … Read more